The Jones Financial Plan for Nonprofit Organizations is a strategy designed to help nonprofits manage their finances effectively while staying aligned with their mission. It focuses on budgeting, diversifying income, managing risks, and maintaining transparency to ensure long-term financial stability and greater impact.

Are you looking for a smarter way to secure your nonprofit’s financial future? Discover how the Jones Financial Plan for Nonprofit Organizations can transform the way you manage money, build trust with donors, and achieve lasting impact.

Understanding the Jones Financial Plan:

The Jones Financial Plan for Nonprofit Organizations is a financial strategy designed specifically for nonprofits. It helps organizations manage their money effectively while staying focused on their mission.

The plan focuses on key areas like creating a clear budget, finding multiple ways to raise funds, and managing risks with reserve funds. These steps help nonprofits stay financially stable, even in tough times. Transparency is also a big part of the plan.

By sharing clear and honest financial reports, nonprofits can build trust with donors and partners. With the Jones Financial Plan, nonprofits can use their resources wisely, grow their impact, and secure a strong future.

The Pillars of Jones Financial Planning –Don’t Miss Out!

Budgeting and Forecasting:

- Importance of creating flexible budgets.

- Tools and techniques for accurate forecasting.

Revenue Diversification:

- Overcoming the risks of dependency on single funding sources.

- Examples of diverse revenue streams (e.g., grants, social enterprises, membership fees).

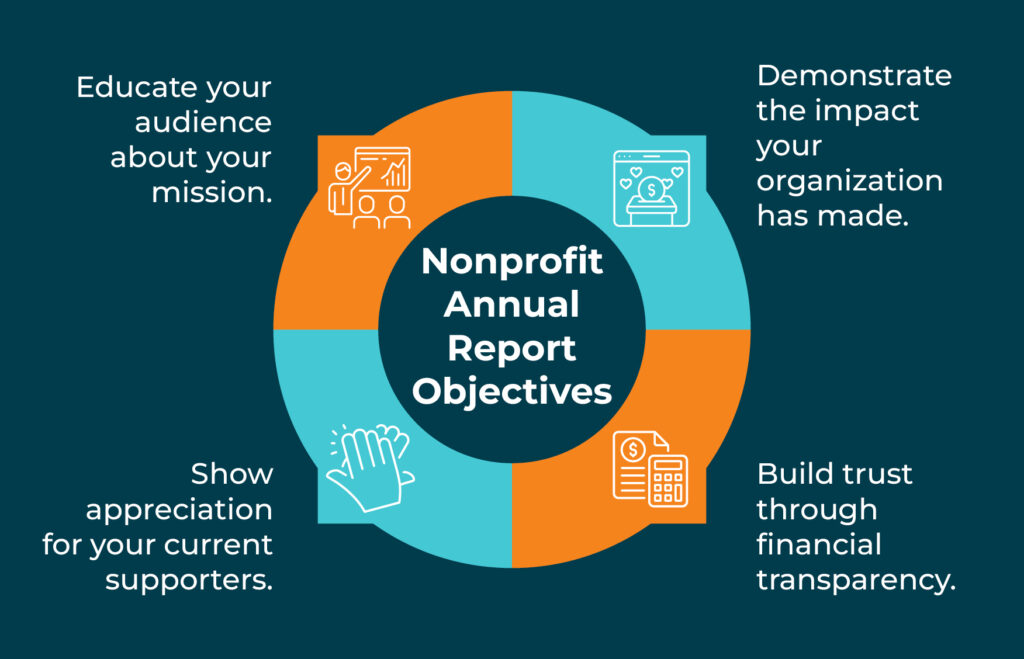

Transparency and Accountability:

- Best practices for financial reporting.

- Tools for donor communication and regulatory compliance.

Risk Management and Contingency Planning:

- Building reserve funds.

- Proactive strategies for economic downturns or funding losses.

Read More: Cute:I1cdycptg50= Drawings – The Art Of Cuteness!

Step-by-Step Implementation Guide of the Jones Financial Plan:

- Assess Your Current Financial Situation: Start by reviewing your financial statements, budgets, and funding sources. Understand where your nonprofit stands in terms of income, expenses, and overall financial health.

- Set Clear Financial Goals: Define what you want to achieve, such as building a reserve fund, diversifying income streams, or improving transparency. Ensure these goals align with your nonprofit’s mission.

- Develop a Detailed Budget: Create a budget that accounts for all expected income and expenses. Focus on directing funds to your most impactful programs while minimizing unnecessary costs.

- Diversify Income Sources: Reduce dependence on one funding source by exploring new opportunities like grants, corporate sponsorships, fundraising events, and earned income.

- Build a Reserve Fund: Set aside savings to handle unexpected costs or financial downturns. This safety net will help maintain stability during uncertain times.

- Invest in Financial Tools and Training: Use budgeting software and donor management systems to streamline financial processes. Train your team to improve financial literacy and efficiency.

- Create Transparent Reporting Practices:

Regularly share financial updates, including audits and impact reports, with donors and stakeholders. Transparency builds trust and attracts more support.

- Monitor and Adjust:

Review your financial performance regularly to ensure you’re meeting your goals. Adjust your strategies as needed to adapt to changes in funding or operations.

Read More: Money 6X REIT Holdings – Join the Conversation!

How long does it take to see results – Start Planning Today!

The time to see results from the Jones Financial Plan depends on your nonprofit’s goals and current situation. Improvements like better budgeting or clearer reports can show positive changes within a few months.

Larger goals, like creating a reserve fund or finding new funding sources, may take 6–12 months. Long-term growth and stability usually require 1–3 years of consistent effort. By sticking to the plan and adjusting as needed, your nonprofit can achieve steady progress.

Practical Tools and Resources for Nonprofits – Stay ahead!

- Budgeting Software: Tools like QuickBooks, Xero, or Wave can help nonprofits track income and expenses, set budgets, and generate financial reports easily. These tools save time and ensure accuracy in managing finances.

- Donor Management Systems: Platforms such as DonorPerfect or Bloomerang help nonprofits track donations, manage relationships with supporters, and automate communication, making it easier to build donor trust and increase funding.

- Grant Management Tools: Software like Fluxx or Fondant helps nonprofits track and manage grants, from application to reporting, ensuring compliance and timely submission.

- Fundraising Platforms: Websites like GoFundMe, Kickstarter, or Classy help nonprofits run online fundraising campaigns, making it easier to reach more donors and raise funds for specific projects.

- Financial Training and Resources: Nonprofits can access online courses, webinars, and articles on financial literacy and management from platforms like Nonprofit Learning Lab or Idealware to improve their team’s financial skills.

- Reserve Fund Calculators: Online tools like the Nonprofit Finance Fund’s calculators help organizations determine the appropriate size for their reserve fund, ensuring financial stability during tough times.

Read More: Charizard:Ttw47p-Wxcy= Pokémon – This Legendary Fire-Type

Is it suitable for small nonprofits – Access Exclusive Resources Now!

Yes, the Jones Financial Plan is suitable for small nonprofits. Its principles, like budgeting, diversifying income, and maintaining transparency, can be scaled to fit smaller organizations with limited resources.

By focusing on simple, actionable steps, small nonprofits can strengthen their financial health, build trust with donors, and plan for sustainable growth. Even with a smaller team, the plan provides a clear path to stability and success.

Common Financial Challenges for Nonprofits and How to Overcome Them?

Unstable Funding Sources

Nonprofits often rely on inconsistent donations or grants. To overcome this:

- Diversify income through sponsorships, earned income, or recurring donations.

- Develop long-term partnerships with reliable donors.

Cash Flow Issues

Irregular income can lead to operational disruptions. Address this by:

- Regularly monitoring cash flow to predict shortfalls.

- Establishing a reserve fund for emergencies.

Read More: Örviri – Unveiling A Cultural Enigma!

Inadequate Budgeting

Without proper planning, nonprofits risk overspending. To prevent this:

- Create detailed budgets that include fixed costs and emergency funds.

- Review and update budgets regularly to reflect changing needs.

Limited Financial Literacy

A lack of financial expertise can hinder decision-making. To improve this:

- Provide financial training for staff and volunteers.

- Use tools like budgeting software to simplify financial management.

Compliance and Reporting Challenges

Complex regulatory requirements can be overwhelming. To manage this:

- Use financial management software to automate reporting.

- Consult with experts to ensure compliance with laws and standards.

How often should the financial plan be updated?

Nonprofits should review and update their financial plan at least once a year to ensure it matches their current goals, funding, and operations. This helps the organization stay on track and use resources effectively.

If there are big changes, like new funding sources, economic shifts, or new programs, the plan should be updated more often. Regular updates keep the organization flexible and prepared for challenges or opportunities.

Read More: NebraskaWut Cappello – Find Your Perfect Style!

Advanced Strategies for Nonprofit Financial Success:

- Diversify Revenue Streams:

Relying on one funding source can be risky. Explore grants, individual donations, corporate sponsorships, and earned income to ensure stability.

- Build Endowments:

Establishing an endowment fund provides a steady income stream over time, helping your nonprofit stay financially secure during tough times.

- Adopt Data-Driven Fundraising:

Use analytics to identify donor trends, optimize campaigns, and focus on high-impact fundraising efforts.

- Invest in Technology:

Leverage financial management software, donor management systems, and automation tools to streamline operations and enhance efficiency.

- Develop Strategic Partnerships:

Collaborate with other organizations, businesses, or government entities to share resources, reduce costs, and expand your reach.

- Create a Financial Reserve:

Set aside a reserve fund to cover unexpected expenses or revenue shortfalls, ensuring uninterrupted operations.

- Regular Performance Reviews:

Evaluate your financial performance using key metrics like cash flow, fundraising ROI, and expense ratios to make informed adjustments.

- Seek Expert Advice:

Consult financial advisors or nonprofit specialists to develop advanced investment strategies, manage risks, and explore innovative funding opportunities.

Real-Life Applications of the Jones Financial Plan – discover the Jones Financial Plan now!

The Jones Financial Plan for Nonprofit Organizations helps nonprofits solve real-world financial challenges. For example, nonprofits that rely too much on one donor can use this plan to find multiple income sources, making their funding more stable.

It also encourages creating reserve funds to handle unexpected costs without disrupting programs. Many organizations have used the plan’s budgeting tools to focus money on the most important projects.

Its emphasis on clear financial reporting helps nonprofits earn donor trust and gain more support. By applying these strategies, nonprofits can manage their finances better, grow their impact, and achieve long-term success.

Read More: Cassasse – Know Every Thing About It!

Frequently Asked Questions:

How often should the financial plan be updated?

At least once a year. However, significant changes like funding shifts or program expansions may require more frequent updates.

What are the key benefits of using this plan?

Benefits include improved financial stability, diversified income, better resource management, increased transparency, and enhanced donor trust.

Does the plan help with fundraising?

Yes, it emphasizes effective fundraising strategies like diversifying revenue sources, targeting the right donors, and optimizing campaigns for maximum results.

Can this plan align with the organization’s mission?

Absolutely. The plan emphasizes aligning financial strategies with the nonprofit’s mission and vision to ensure all resources are used purposefully.

Where can I learn more about implementing this plan?

Check out our detailed guides, resources, and step-by-step instructions to start implementing the Jones Financial Plan for your nonprofit today.

Conclusion:

The Jones Financial Plan is a simple yet powerful way for nonprofits to achieve stability, grow, and stay true to their mission. By focusing on smart budgeting, diverse income, risk planning, and clear reporting, it helps nonprofits build trust and prepare for the future.

No matter the size of your organization, this plan can guide you toward long-term success, ensuring you can make a bigger impact and stay ready for new challenges. Start today and secure a stronger future for your nonprofit.

Read More: