I’ve invested in Money 6X REIT Holdings for a few months, and it’s been great. The regular dividends help my passive income, and the mix of properties keeps things safe. It’s a good option for growing wealth.

Money 6X REIT Holdings is a real estate investment trust that offers a mix of property investments. It provides regular income through dividends and aims for steady growth. It’s a good option for investors looking for passive income and diversification.

Curious about how Money 6X REIT Holdings can boost your passive income? In this article, we’ll dive deep into its benefits, investment strategy, and how it can help you grow your wealth.

What Are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are companies that own, manage, or finance income-generating real estate. These trusts allow individual investors to earn returns without owning physical properties, offering exposure to a diversified portfolio of real estate assets.

REITs stand out because they are legally required to distribute at least 90% of their taxable income to shareholders in dividends, making them ideal for income-focused investors. Additionally, they’re publicly traded, meaning shares can be bought and sold easily on stock exchanges.

Why Money 6X REIT Holdings?

Money 6X REIT Holdings is a leading name in the REIT sector, offering unique advantages such as:

- Diverse Portfolio: Includes properties across residential, commercial, and industrial sectors.

- Professional Management: A team of experts ensures assets generate consistent returns.

- Liquidity: Shares are easily tradable, offering flexibility to investors.

- Transparency: Regular reporting on financial metrics keeps investors informed and confident.

Read More: Taelyn Dobson – A User-Friendly Guide

How Money 6X REIT Holdings Generates Passive Income – Start Earning Passive Income Today!

Money 6X REIT Holdings generates passive income by investing in a diversified portfolio of income-producing real estate properties, such as residential, commercial, and industrial buildings. These properties generate rental income, which is then distributed to shareholders in the form of dividends.

The REIT is required by law to pay out at least 90% of its taxable income as dividends, ensuring regular payouts to investors. This structure allows investors to earn passive income without the need to directly own or manage real estate.

Benefits of Investing in Money 6X REIT Holdings – Discover strategies!

- Passive Income: Earn regular dividends through investments in a diversified portfolio of real estate properties.

- Diversification: Spread your investment across different property sectors (residential, commercial, industrial), reducing risk and providing more stable returns.

- Liquidity: Unlike traditional real estate investments, Money 6X REIT Holdings allows easy buying and selling of shares on the stock market, providing quick access to your funds.

- Growth Potential: The REIT invests in properties with strong growth potential, offering the chance for both income and capital appreciation.

- Lower Risk: The REIT’s focus on a diversified portfolio helps manage risk better, even during market downturns, making it a safer investment option.

- Accessible for All: Ideal for both new and experienced investors looking to invest in real estate without the hassle of property management.

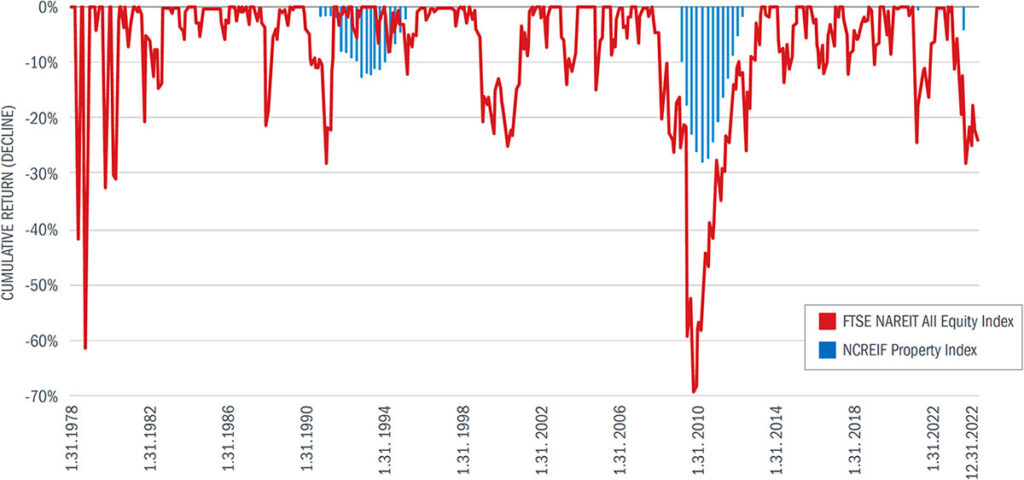

REITs Surpassed Most Asset Classes – 1998 to 2022!

From 1998 to 2022, Real Estate Investment Trusts (REITs) demonstrated significant outperformance compared to various asset classes, primarily due to their unique structure and investment characteristics. Here are the key insights regarding their performance during this period:

Read More: What Companies Are In The Consumer Services Field – Your Comprehensive Guide!

Performance Overview

- Outperformance Against Private Real Estate: A study conducted by CEM highlighted that REITs outperform private real estate investments by nearly 2.3% annually from 1998 to 2022. This indicates that publicly traded REITs provided better returns than direct investments in real estate assets over the same timeframe.

- Historical Returns: The FTSE Nareit All Equity REITs Index reported a trailing 25-year annualized total return of 8.2%, with REITs outperforming the S&P 500 in 15 out of the last 25 years. This consistent performance illustrates the resilience and attractiveness of REITs as an investment vehicle.

- Diversification Benefits: REITs have been recognized for their low correlation with other asset classes, making them an effective tool for portfolio diversification. Their unique income generation from rental properties provides reliable cash flows, which can enhance overall portfolio performance and reduce risk.

Comparative Analysis

| Asset Class | Average Annual Return (1998-2022) | Notes |

| REITs | ~8.2% | Outperformed private real estate by 2.3% |

| S&P 500 | ~6.0% | Lower average returns compared to REITs |

| Bonds | ~5.0% | Generally lower returns than equities |

| Gold | ~4.0% | Historically volatile, lower than REITs |

| Cash | ~1.5% | Minimal returns, often lagging inflation |

What Are The primary types of real estate covered in this REIT?

- Residential Properties: This category includes apartment complexes and rental homes, which provide steady rental income due to consistent demand.

- Commercial Real Estate: Office buildings, shopping centers, and mixed-use spaces fall under this category, often yielding higher returns but with some market volatility.

- Industrial Real Estate: Warehouses, logistics centers, and manufacturing sites are part of this segment, benefiting from the growing e-commerce and supply chain demand.

- Healthcare Real Estate: Hospitals, medical offices, and senior living facilities provide long-term rental income, driven by constant demand in the healthcare sector.

- Hospitality Properties: Hotels and resorts are also included, capturing the potential gains from tourism and travel trends, although subject to seasonal fluctuations.

Read More: Fintechzoom Mortgage Calculator – Mastering Your Mortgage!

Can I hold Money 6X REIT shares in a retirement account?

Yes, you can hold Money 6X REIT shares in a retirement account, such as an IRA or 401(k). This allows you to grow your investment on a tax-deferred basis, providing potential tax benefits and enabling long-term wealth accumulation for retirement. Always check with your retirement plan provider to ensure that the specific REIT shares are eligible for inclusion in your account.

How to Invest in Money 6X REIT Holdings – Don’t miss out!

Step 1: Open an Investment Account

Choose a brokerage platform that offers access to REITs. Popular options include Fidelity, Vanguard, or Charles Schwab.

Step 2: Research Market Conditions

Analyze economic trends, including interest rates and market demand, to identify the best times to buy shares.

Step 3: Start Small and Diversify

Allocate a portion of your portfolio to Money 6X REIT Holdings while balancing it with other asset classes or REITs.

Step 4: Monitor and Reinvest Dividends

Use dividend reinvestment plans (DRIPs) to compound your gains and grow your investment over time.

Read More: Blueface Net Worth – Everything You Need To Know!

Tips for successful investment in money 6x reit holdings – Learn More!

To make the most of your investment in Money 6X REIT Holdings, it’s a good idea to spread your money across different types of investments. While Money 6X already offers a variety of properties, investing in other things like stocks or bonds can help lower your risk.

Another useful tip is to reinvest the money you earn from dividends. By doing this, you can increase your investment over time and see bigger returns in the future. It’s also important to keep an eye on the market because things like interest rate changes and the economy can affect property values and rental income.

What Are the Main Risks of Investing in Money 6X REIT Holdings?

- Market Fluctuations: Like any investment in real estate, the value of REITs can be affected by economic downturns, changes in interest rates, or shifts in market conditions.

- Sector Risk: Money 6X REIT Holdings may be diversified across different real estate sectors, but any specific sector (e.g., retail or office spaces) can face challenges that affect the REIT’s overall performance.

- Liquidity Risk: While publicly traded, the liquidity of the REIT depends on market conditions, and there may be times when it is harder to sell shares quickly at favorable prices.

- Dividend Cuts: If the REIT’s properties underperform or face financial challenges, there could be a reduction or suspension of dividend payouts to investors.

- Management Risk: The performance of the REIT depends on the effectiveness of its management team in selecting properties and managing them successfully.

Read More: Chargomez1 – Join Discussion!

Frequently Ask Questions:

Is Money 6X REIT Holdings suitable for beginners?

Yes, Money 6X REIT Holdings can be suitable for beginners because it offers an easy way to invest in real estate without the complexities of direct property ownership, management, or maintenance.

How often are dividends paid by Money 6X REIT Holdings?

Dividends from Money 6X REIT Holdings are typically paid on a quarterly or monthly basis, depending on the specific REIT structure.

How does Money 6X REIT Holdings handle market downturns?

Money 6X REIT Holdings aims to mitigate risks by diversifying its property portfolio across multiple sectors, which helps reduce the impact of downturns in any one particular market.

How can I buy shares of Money 6X REIT Holdings?

You can buy shares of Money 6X REIT Holdings through major stock exchanges by opening an account with a brokerage firm. Once your account is set up, you can purchase shares just like you would with any other publicly traded stock.

Can I sell my shares of Money 6X REIT Holdings?

Yes, you can sell your shares of Money 6X REIT Holdings at any time through a brokerage account. As it’s a publicly traded REIT, you have liquidity, meaning you can buy and sell shares just like stocks.

Conclusion:

Money 6X REIT Holdings offers a unique opportunity to invest in real estate without the stress of property management. With its focus on diversification, consistent dividends, and growth potential, it’s an excellent choice for both income-seeking investors and those aiming for long-term wealth creation.

Read More: